Home |

The Financial Page  Visit Keith's Financial Page on Facebook

Visit Keith's Financial Page on Facebook

Eliminating

Debt...Completely! Visit Keith's Financial Page on Facebook

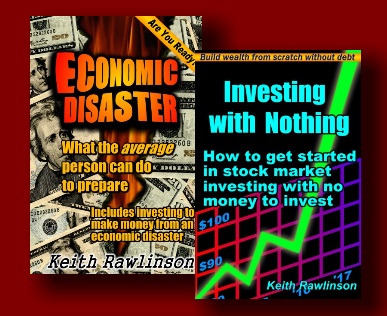

Visit Keith's Financial Page on Facebook | I have some really great eBooks available! Click HERE for more information. |

by Keith Rawlinson

Volunteer Budget Counselor