By Keith Rawlinson

Volunteer Budget Counselor

|

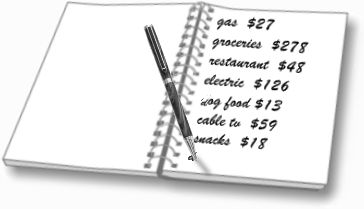

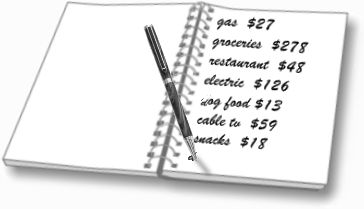

| How To Do a Spending Journal By Keith Rawlinson Volunteer Budget Counselor |

| To

learn a lot more about saving, investing,

eliminating debt and

becoming wealthy, please read the articles

on the Financial Page.

There, you will find a veritable treasure of what to do and

how to do

it. |